Blog

MGAs and the Changing Insurance Landscape

MGA growth has been hot the last few years! Why is it so exciting to be an MGA in today’s insurance market? How can MGA’s benefit from modern insurance technology to facilitate profitable growth?

If you’re familiar with Instagram, TikTok, or YouTube, you’ve seen the growth of new channels for marketing in action. It’s a popular route to reach new markets, especially for retailers with reduced brick-and-mortar locations. Williams-Sonoma, for example, the kitchen and home retailer, is supplementing their traditional channels with more social media marketing through platforms such as Instagram.

Williams-Sonoma still handles its traditional sales channels, including its web presence, extremely well. It is mature in its use of data and shrewd in its ability to keep prices where it wants them. They currently use AI and e-mail marketing to keep track of individual shoppers and the products they are considering. As most retailers do, it grapples with a decrease in its brick-and-mortar locations.

Williams-Sonoma is, however, capitalizing on trends in social media marketing. They partner with influencers and other brand partnerships to widen their reach and show their products in real-world use. The result is that their products get sold through other sites and storefronts, often placing them in front of markets they had no access to before. They have proven that if you can’t spread your existing brand net — add more nets.

Brands that expand demand

Managing general agents are the new, sought-after nets. It’s difficult to overemphasize the impact MGA’s are having on the insurance industry. For those who recognize there are necessary changes in the insurance industry for insurance to remain relevant, MGAs hold the keys to both relevance and profitable growth. Whether they are going solo with one insurer or they are partnering with multiple insurers to grow within their niche — MGAs are all part of a trend toward reaching the previously unreachable. They are using niche expertise and placement opportunities to provide coverage — often for unique risks that demand specific products, whether traditional of new.

Traditional insurers find greater flexibility and choice in partnering with managing general agents, rather than establishing their own dedicated insurance operations for niche business segments. McKinsey noted in a 2022 article that “among the top 100 U.S. property and casualty insurers, 43%—including seven of the top ten—have at least one MGA insurance relationship through which to source new premiums.”[i]

In the AM Best report dated May 22, 2024, they note that in 2023, direct premiums written (DPW) generated by MGAs grew 8.6% year-over-year to $77 billion, following robust growth in 2022 of 19.5% and 17% percent in 2021, demonstrating the importance of MGAs in the insurance market.[ii] The 2024 annual MGA report by Conning further notes that the MGA market will continue to outpace the broader property-casualty market in terms of growth, primarily due to MGAs’ appeal to both talent and capacity providers.[iii]

AM Best further noted that many insurers are using a hybrid model and have some programs managed by MGAs, with in-house underwriters managing other programs, helping to grow premium market share through MGAs.

Further supporting this growth is the access to capacity and capital from new funding approaches, including insurance-linked securities, collateralized reinsurance, reciprocal exchanges, insurers, reinsurers, and private equity. The growth is a recognition of the market opportunity for MGAs to help insurers and reinsurers grow their premium, expand into new markets and geographies, leverage underwriting expertise, and leverage a new business model and technology foundation that offers greater speed to market capabilities — with a goal to meet the risk needs of a changing marketplace and closing the protection gap of consumers and businesses. This makes MGAs attractive to both top talent (from underwriters to technology professionals) and capital from private equity companies for startups.

Well-timed MGA growth and advancement

With the growing volatility of risk, insurers pulling out of markets, and increased insurance exposure across many lines of business, MGAs and E&S products are uniquely positioned to meet these challenging demands. MGAs are innovating and creating new digital business models that provide new products and experiences for customers, particularly for those in volatile risk markets.

Majesco’s recent research assessed strategic priorities for MGAs — from the business through technology — and weighed these priorities against insurer priorities from Majesco research earlier in the year. We look at how these priorities align (and diverge) to give both insurers and MGAs a better picture of how they might best prepare to partner. Read the full report, MGA Strategic Priorities 2024, for a complete view from both sides of the partnership fence.

MGAs’ strong customer relationships, robust business and technology foundations, and specialized expertise for risks and underwriting differentiate them in the market, providing insurers and reinsurers with risk management expertise they may lack within their organizations. This makes MGAs strong first movers in a rapidly changing world of risk. The research highlights MGAs’ sharp focus on operations and technology, and their forward-thinking leadership that drives optimization, growth, and long-term business innovation.

As the insurance market continues to adapt and evolve, winners will be aligned to today’s realities—MGAs focus on unique, complicated risks, and insurers and reinsurers on the partnerships they establish with MGAs. Accomplishing this requires a foundation, both operationally and technologically, to achieve operational optimization, cost-effective scalability, and agility to adapt as risk and market needs shift through innovation.

An MGA snapshot

The breakneck pace of change, particularly with emerging risk and technology, is challenging strategies and plans of MGAs’. As InsurTech has matured and advanced, and private equity has accelerated investment in MGAs, we are seeing the value of first-mover status.

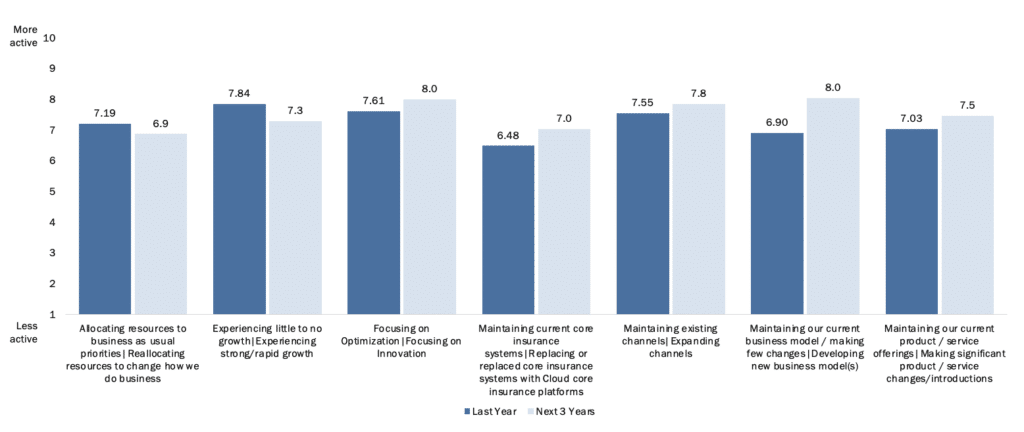

Whether bringing new products to market, expanding to new niche markets, or leveraging data and analytics, and technology, managing general agents demonstrating strong growth, expanding insurer and reinsurer relationships and market presence are taking advantage of first-mover status. They have strengthened business fundamentals and technology foundations while meeting the challenges of a changing market, as seen in Figure 1.

Last Year and the Next Three Years

When comparing last year to the next three years, MGAs are shifting their focus from business as usual to creating the business and technology foundation needed to compete in an increasingly shifting and complicated world of risk. This requires expanded use of data and analytics for assessing and underwriting risk. It requires new products, and native cloud core solutions to meet the demands of a different operating model and channel network.

Figure 1: MGAs’ assessments of their business last year and expectations for the next three years

The 2024 Conning report reinforces this focus, with MGAs indicating the abundance of market opportunities, but with an increased need for specialization and nimbleness to effectively serve a growing number of niche markets emerging due to increasing and shifting risks. This will allow MGAs and their partners to capture market share.

MGAs need to expand their ability to be nimble, specialize, and leverage their underwriting expertise effectively.

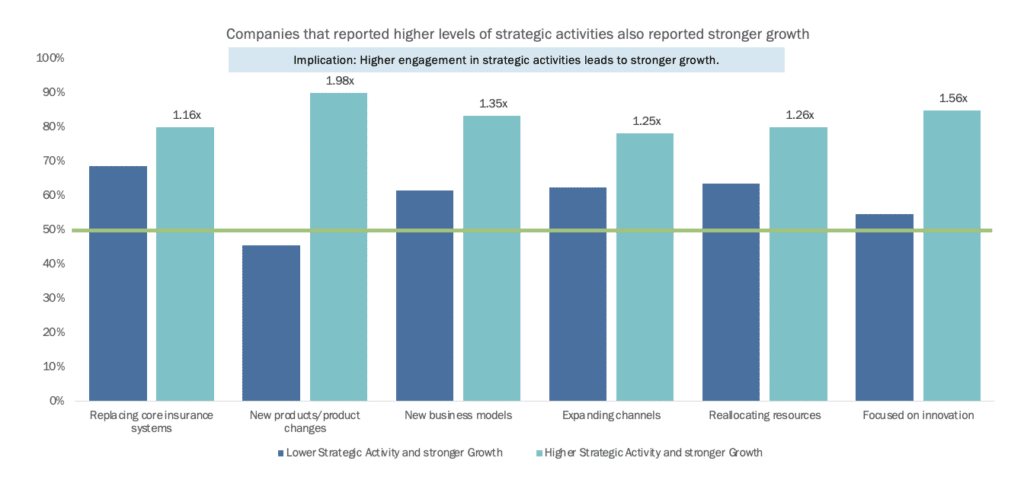

The right investment across key areas makes a substantial difference in growth. Those focused on and investing in replacing legacy core, creating new products, defining new business models, expanding channels, reallocating resources to the future business, and innovation initiatives report significantly higher growth than those who do not – from 1.16 to 1.98 times difference. See Figure 2.

Not surprisingly, new products and product changes as well as innovation stand out – two areas of unique strength for MGAs.

Figure 2: Higher engagement in strategic activities leads to stronger growth

Top-of-Mind Issues

The insurance market is facing many headwinds, driven by heightened volatility in financial markets, economic activity, and an increased risk environment. Navigating this uncertainty is not for the faint of heart. It requires leaders to diligently execute their strategy and adapt where they need to remain relevant and competitive in this fast-changing market landscape.

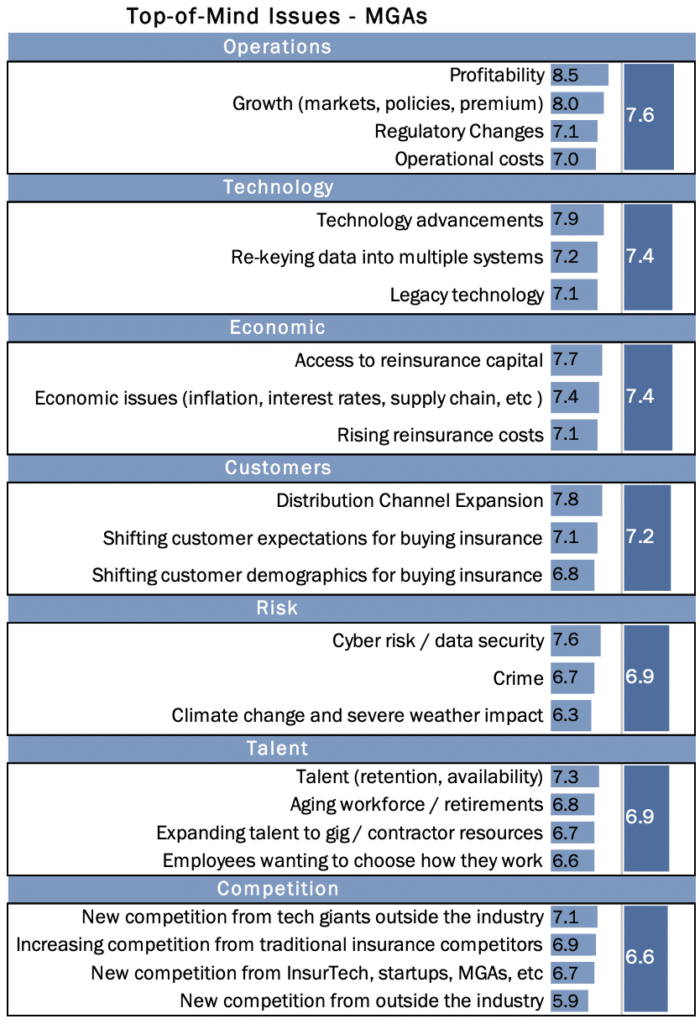

Reflecting this new reality in Figure 3, MGAs’ top-of-mind issues reflect market challenges regarding their business model and technology foundation being out of step with a new reality taking hold. Operations, technology, and economic issues are the top three categories, with the other four not falling far behind.

These results align with the Conning report, which found that:

- Volatility and coverage gaps across several lines of business have resulted in a shift to the E&S market, where MGAs are key.

- Technology is a great source of opportunity and is increasingly a foundational requirement to be competitive.

- The increase in capacity from a variety of sources is allowing programs to expand and scale.

- Demand for talent and expertise is a key driver for profitable growth, with the use of technology a key element to attract talent.

Figure 3: MGAs’ Top-of-Mind issues

Based on a 10-point scale where 1 meant “Not at all” and 10 meant “Very much”

In an increasingly complex risk environment, the patchwork of legacy, spreadsheets, and manual solutions cannot keep up with the increasing demands of leveraging expanding data, advanced analytics, underwriting workbench, and core solution capabilities to effectively assess and underwrite risk. It is too difficult (and resource-consuming) to engage agents and customers, empower decision-making, and meet the growing demands of partner insurers and reinsurers without addressing MGA technology shortfalls.

Even more important is the likely growing oversight from AM Best and other regulatory organizations that will expect a more robust business and technology foundation and improved compliance reporting.

Strategic Initiatives

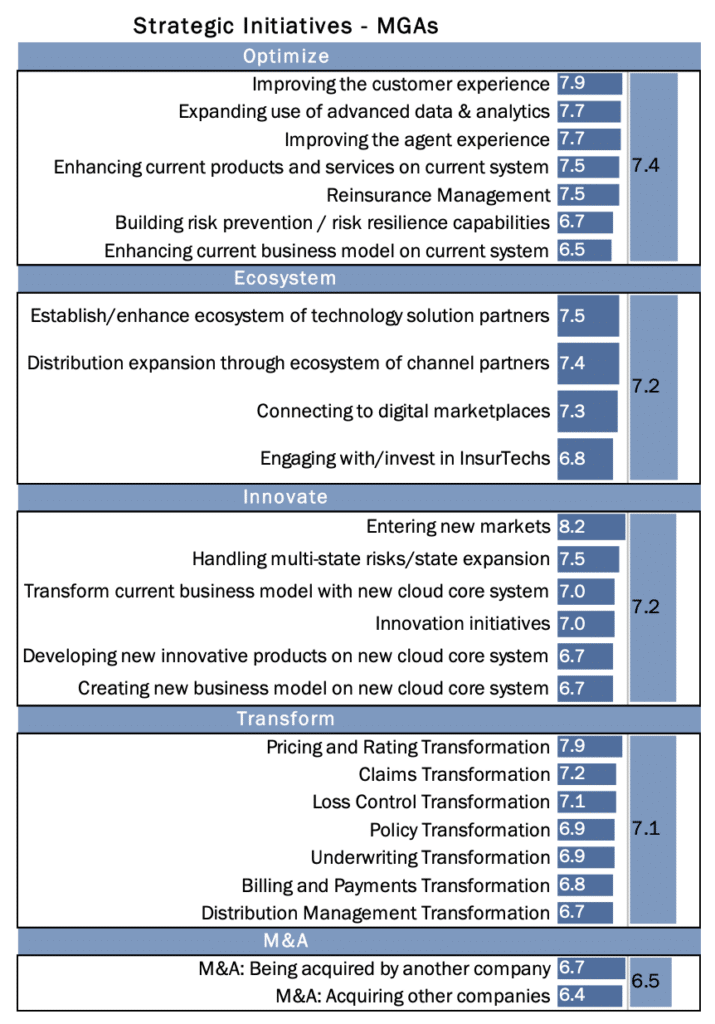

The Majesco research placed strategic initiatives into four categories with an additional category for M&A, as reflected in Figure 4. While the category Optimize leads the strategic initiatives, there is very little difference between the four main categories, reflecting that the state of MGAs is very much in flux with a focus on transforming, optimizing, and innovating the business to meet the increasing market, regulatory, and customer demands.

Within the four categories, the top five initiatives are:

- Entering new markets (8.2)

- Pricing and rating transformation (7.9)

- Improving customer experience (7.9)

- Expanding use of advanced data and analytics (7.7)

- Improving agent experience (7.7)

These all relate to the unique strengths of MGAs – niche products, underwriting expertise, and agent relationships. Accomplishing these to scale and optimize the business requires technology investments, leveraging next-gen architectures with native cloud, API first, microservices, headless, and embedded analytics. Legacy, AMS, or spreadsheet-based solutions no longer suffice.

Figure 4: MGAs’ Strategic Initiative priorities

Based on a 10-point scale, where 1 meant “Not at all important” and 10 meant “Very important”

Technology is a key differentiator for MGAs to compete with large insurers and ensure profitable underwriting. The rapid advancement of native cloud solutions with subscription-based pricing based on DWP has offered more options for MGAs to create a technology foundation to transform and optimize their business, while also innovating with new products and using advanced data and analytics to give them a competitive edge. The result is greater value for their business, their insurance and reinsurance partners, agents, and customers.

With their increasingly important role, investment in a solid technology foundation is a must to minimize their own operational and financial risk. Staying ahead of the technology curve is mandatory in an increasingly data and tech-driven industry.

Budget Priorities

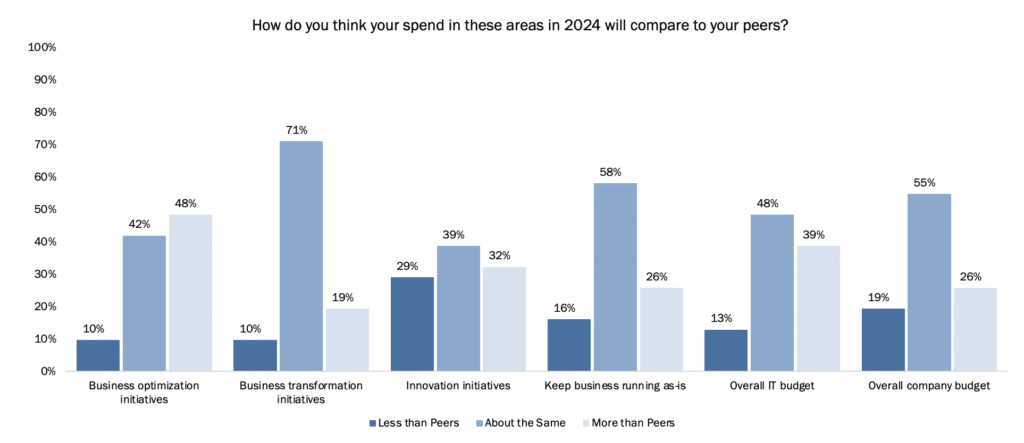

With increased focus on these strategic initiatives, it would be reasonable to expect that budgets would reflect these priorities. Unfortunately, there is a misalignment as they consider what they are spending in comparison to their peers, as reflected in Figure 5. Most appear to believe their budget is the same except for business optimization, where they believe they are spending more than their peers.

Figure 5: MGAs’ expected 2024 spend compared to their peers

That is a questionable assessment, particularly given the number of PE-backed MGA startups and the number of MGAs acquired by PE firms that are raising the bar by creating significant value through the use of advanced data and analytics and next-gen technology to create highly efficient, optimized and profitable businesses with better cost ratios, combined ratios, and business results in a highly fragmented MGA marketplace.

The biggest risk for an MGA is for the insurer relationship to be reduced or stopped, resulting in a lack of capacity to sell and underwrite their products. MGAs can minimize this risk operationally through increased spending on technology to truly transform, optimize and innovate the business to remain relevant in a fast-changing marketplace.

Because cloud insurance solutions are financially-scalable, as mentioned above, MGAs do not need to fear the loss of profits through technology modernization. In fact, the reverse should prove true — technology foundation improvements may rapidly enhance capabilities in ways that could super-charge growth and improve MGA’s “attractiveness” to their capacity providers.

For insurers partnering with MGAs, the same holds true. Technology frameworks that expertly handle data and improve efficiency and transparency, will make it far easier to plug and play MGA products and partnerships, thus expanding insurer market reach, growing premiums, and giving everyone more experience in non-traditional risk.

Is your organization ready to capitalize on MGA trends? Are you wondering where your company could improve its agility and capability to reach new markets? Let Majesco demonstrate to you how our native cloud solutions and innovations address your strategic priorities and allow you to chart a course for unreached markets. Listen to some of our customers who are accelerating their growth and innovation on our podcasts. Contact us today. And, find out more about the synergies and alignment opportunities to be found between insurers and MGAs by reading our thought-leadership report, MGA Strategic Priorities 2024.

[i] Grier Tumas Dienstag, et al., “Insurance MGAs: Opportunities and considerations for investors,” McKinsey, August 30, 2022, https://www.mckinsey.com/industries/financial-services/our-insights/insurance-mgas-opportunities-and-considerations-for-investors

[ii] “Rapidly Increasing MGA Premiums Warrant Greater Oversight,” AM Best, May 22, 2024

[iii] “Managing General Agents: Ahead of the Pack,” Conning, 2024