Blog

Are Insurance Price Increases a Tipping Point for Gen X and Boomers?

Jackie is 53, and she owns two cars. Her first car is a small SUV — her daily driver. Her second is a convertible, her fun car that she only drives on weekends from late spring through early fall when the weather is optimal. She puts 2,500 miles per year on the convertible. When she recently realized that her premiums for both vehicles were nearly identical (and they had both gone up), she called her insurance agent. The agent suggested a telematics-based insurance product for the convertible to optimize pricing.

Two years ago, if you had asked Jackie if she was willing to share her driving data with her insurer, she would’ve said, “No way.” Today, she has reached a tipping point. The potential premium savings are worth the data sharing. She is now fully “bought in” to the idea of the insurance/customer partnership.

The tipping point mindset shift — a toehold for insurers in a disrupted market.

The traditional insurance customer relationship is being re-examined and, in some cases, re-energized by the need to address higher risk and higher premiums. Today’s GenX and Boomer customer is looking more and more like the Gen Z and Millennial cohort — less privacy conscious, less resistant to change, more open to technology, and perhaps a bit less loyal. Are insurers ready to capitalize on the impact of today’s customer tipping points at the same time they protect the customer relationships?

In the last decade, Majesco’s annual customer surveys and strategic reports have analyzed and measured customer sentiment across a wide spectrum of life, work, and business topics. Our goal? To help insurers know how to engage customers in the insurance process and how to retain insurance customers — using available technologies to improve process and profits. If insurers need to continually assess and adjust their strategies and priorities to meet customer needs, they also need to know which changes will have the greatest impact and why.

Customer tipping points can make a big difference in purchase and renewal patterns. If customers are increasingly ready for new products and processes, insurers should be ready to give them what they want. In Majesco’s recent Thought Leadership report, From Trust to Technology: The Tipping Point for Insurance Customers, we dive deep into motives and issues that are impacting today’s insurance customers. It’s another way of looking at how data-driven insurance decisions can revolutionize insurance operations.

Is this tipping point only for Gen X/Boomers?

From a demographic perspective, it is helpful to track Gen Z/Millennials against Gen X/Boomers. While the younger generational group is tech-savvy, comfortable with online engagement and buying, and has different risk needs and interest in different products, the older generation of Gen X and Boomers tend to have a more traditional approach, relying on traditional products and agent channels.

Both generational groups are experiencing related tipping points, however, due to the effect of inflation on insurance premiums. For Gen Z/Millennials, financial considerations are paramount. They have, on the whole, less income. They weigh choices differently. They buy differently. You can read more in one of my previous blogs about the Gen Z/Millennial tipping point.

However, Majesco’s research finds Gen X/Boomer similarities to the younger generation, highlighting the need for insurers to offer options for their customers across all generational groups.

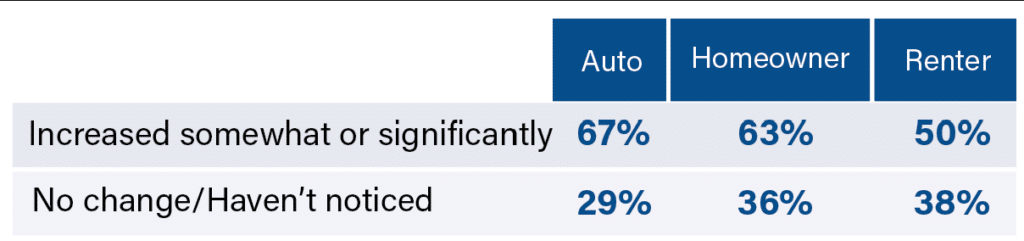

P&C insurance has seen the highest increase in insurance price increases over the last two years, sometimes 20-30% or more, and has had a significant financial impact on consumers given their challenges, as reflected in Table 1 below. Gen X and Boomers have noticed increases more than the younger generation. And even though far fewer Gen X and Boomer customers were renters (19%) as compared to Gen Z and Millennials (35%), half of this smaller segment said their cost increased somewhat or significantly, 10 percentage points more than Gen Z and Millennial renters.

Table 1: Reported changes in P&C insurance costs by Gen X & Boomer customers

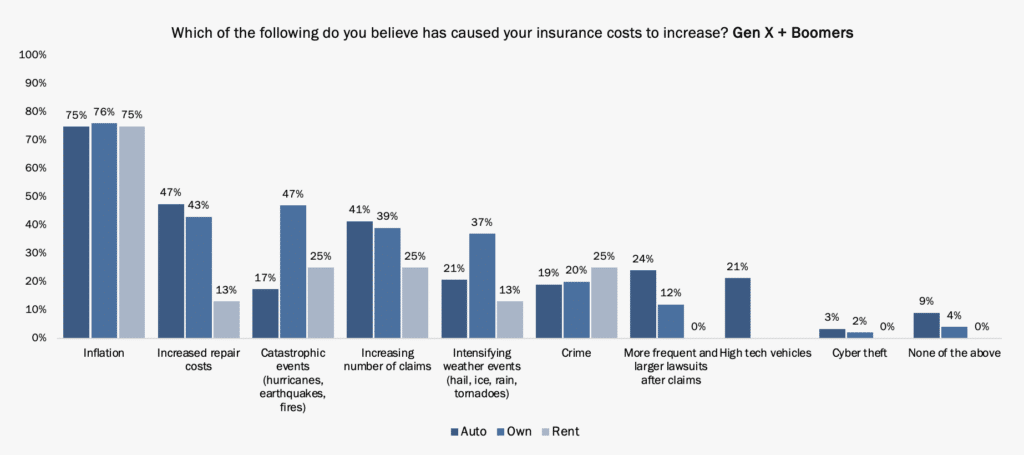

Inflation was far and away the most cited reason across all coverage types, at 75%, which aligns strongly with their number one top-of-mind issue (Inflation and the economy). Increased repair costs, a component of inflation, was cited by nearly half for both auto and homeowner insurance and is far higher than Gen Z and Millennials, likely reflecting the years of owning insurance and understanding the makeup of claims costs. Catastrophic events (47%), intensifying weather events (37%), and a resulting increasing number of claims (39%) are also felt to be significant drivers of homeowner cost increases.

Auto insurance repair costs align strongly with the number of claims, increasing and driving up insurance costs. Weather and catastrophic events, crime, more frequent and larger lawsuits, and high-tech vehicles also contribute significantly to their perceptions of what is driving up auto insurance costs.

After inflation, renters cited only three other significant drivers of cost increases, each at 25%: catastrophic events, intensifying weather events, and crime.

Figure 1: Gen X & Boomer customers’ perceived causes of increases in cost of P&C insurance

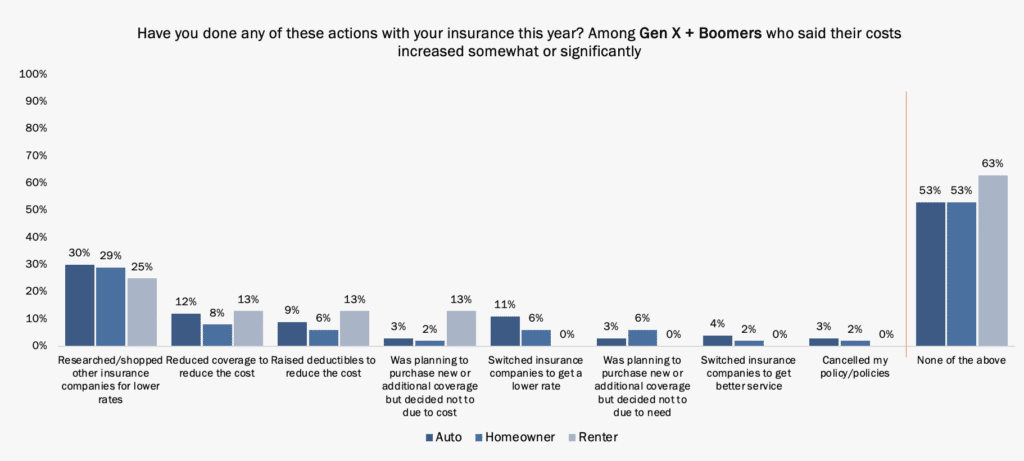

This older generation has years of history with insurers, with manageable increases as compared to the last few years, resulting in strong loyalty and trust. This trust and loyalty are reflected in that they are less likely than the younger generation to take actions to reduce costs. Over half of Gen X and Boomer customers who experienced increased insurance rates didn’t take any actions to reduce their costs: 53% of homeowner and auto customers and 63% of renters insurance customers took no actions as reflected in Figure 2.

Among those who did take action, researching/shopping other companies for lower rates occurred the most, with 25% for renters, 29% for homeowners, and 30% for auto insurance. However, following the research, only 11% for auto and 6% for homeowner customers followed through and switched carriers for a lower rate; no renters insurance customers did, emphasizing the built-up value of loyalty and trust of GenX/Boomer customers.

For those who did remain, the most active cost-reducing actions included reduced coverage (auto, 12%; renters, 13%) and raising deductibles (auto, 9%; renters, 13%) which increased their protection gap and could result in challenges for insurers in the future with claims that could ultimately impact loyalty and trust.

Figure 2: P&C insurance-related actions done this year by Gen X & Boomer customers

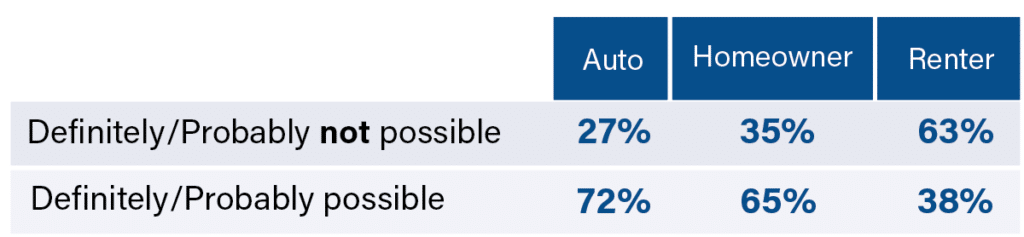

Auto (72%) and homeowner (65%) customers strongly believe they can take actions to reduce their risk, minimize the potential for a claim, and potentially lower the price for their insurance, as seen in Table 2. However, only 38% of renters insurance customers believe they can influence their rates.

Table 2: Gen X and Boomer customers’ belief there are things they can do to reduce risk and chances of having a claim, which could lead to a lower price for their P&C insurance

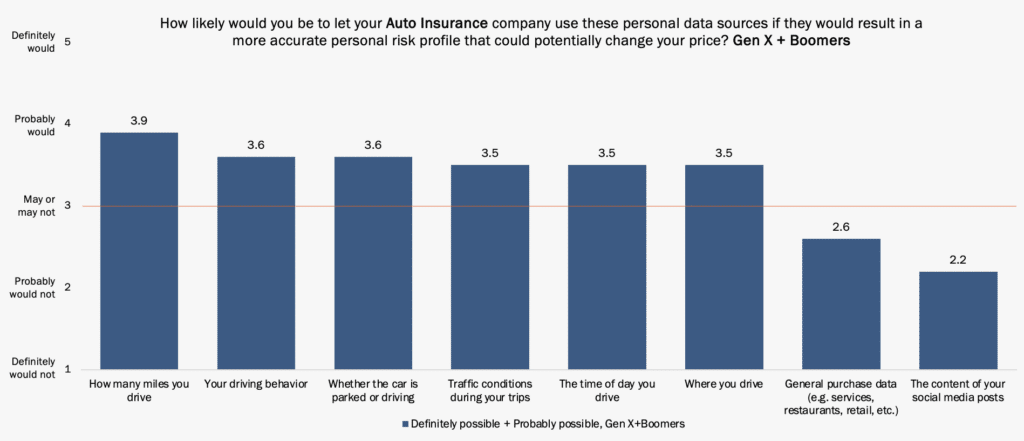

As shown in Figure 3, those with auto insurance who believe they can take actions to reduce their risk profiles will strongly consider using their personal data sources for driving (miles, behavior, time of day, traffic conditions, driving/parked, location) – very similar to the Gen Z and Millennial segment, highlighting once again the growing shift to desiring usage-based and telematics insurance as noted previously.

This is where Jackie landed…allowing her data to dictate her premium because she knows that she is a safe driver with a low-mileage vehicle, driving during non-rush times and parked 95% of the time in her garage.

Figure 3: Gen X & Boomer customers’ likelihood to use personal data sources for auto insurance pricing

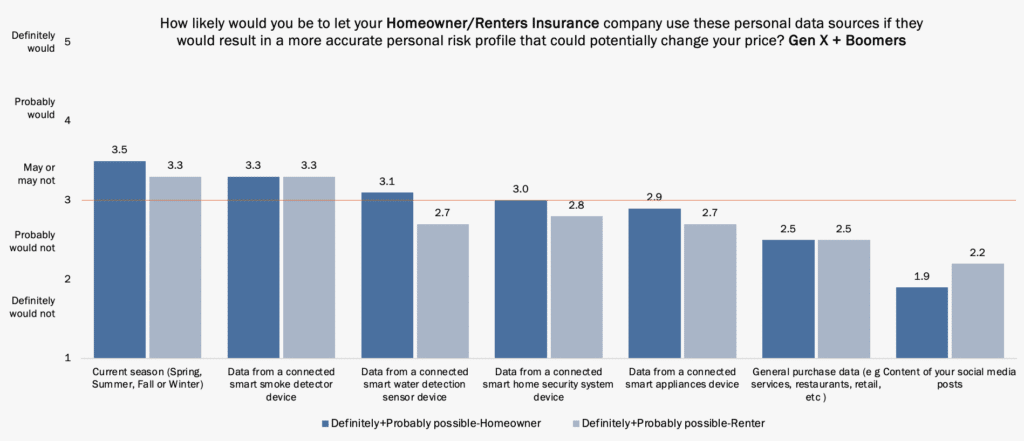

Similarly, for homeowner insurance, Gen X/Boomers are open to using personal data sources to develop more accurate personal risk profiles that could change their rates, as shown in Figure 4. Like Gen Z and Millennials, season-based rates are most popular, but smart home devices are also quite popular, mirroring the acceptance of data from connected devices by Gen X and Boomer auto insurance customers seen above. This acceptance by the older generation once again highlights the rapid increase in use and acceptance of digital devices by all generations, setting the stage for shifting expectations in products sooner than later.

Renters insurance exceeds the mid-point level of interest on only two options, season-based rates and smart home connected smoke detector. Interest in the three other IoT-based options is close to the mid-point level of interest, indicating these options will appeal to some. General purchase data and social media have little interest, similar to the younger generation.

Figure 4: Gen X & Boomer customers’ likelihood to use personal data sources for homeowner or renter insurance pricing

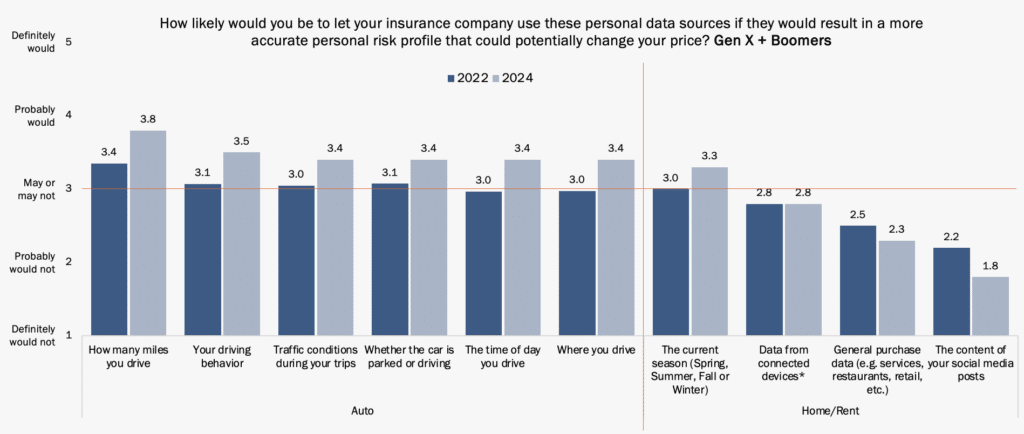

Interestingly, among all Gen X and Boomers for auto insurance, the use of personal data sources showed consistent increases over the 2022 survey, as shown in Figure 5. Homeowner/renters insurance showed higher interest in season-based rates as compared to 2022, and opinions were unchanged but positive about data from smart connected devices. General purchase data and the content of customers’ social media posts declined in popularity.

Figure 5: Gen X & Boomer customers’ likelihood to use personal data sources for P&C insurance pricing, 2022 vs. 2024

Connected, data-driven insurance is now a tipping point for insurers

The conundrum of how to engage insurance customers was recently an issue of insurmountable difficulty for some insurers. They were too far removed from digital capabilities to consider mounting a campaign of new products that could capitalize on rapid data ingestion and decisioning.

But technology capabilities and accessibility for any insurer are changing the game on who gets to take advantage of customer tipping points. It has created a tipping point for insurers that recognize the trends and the stakes. Connected solutions are now available that allow for the use of AI and GenAI in an environment where data can be fully utilized in a fraction of the time it used to take before. But it takes next-gen, cloud core solutions to effectively make that happen.

Majesco, for example, has created an end-to-end Intelligent Core insurance solution that serves as the foundation for both data-driven insights and optimized, automated operations. Data and analytics, and GenAI are embedded in the software, not plugged into the fringe. Hence, every area can take advantage of its features — from product development to customer engagement to underwriting, billing, and claims. It is, from every angle, innovative, opportunity-ready, and responsive to insurers who are at their own tipping points.

Have you reached a transformation tipping point for your organization? Contact Majesco today and be sure to find out more about Majesco innovations at the upcoming webinar, Unveiling Majesco’s Spring 25 Release — Innovation in Action.